PROTECTING WOMEN’S FUTURES

Protecting Women's Futures: from provident funds to government-funded pensions for older people in Pacific Island Countries and Timor-Leste

By Sinta Satriana and Juliet Attenborough

Read the easy read version of this blog

Social protection aims to safeguard people against financial risks and vulnerability, including those associated with ageing. In recent decades, several countries across the Pacific and Timor-Leste have established government-financed universal old age pensions. In doing so, they are making important progress towards offsetting some of the lifelong impacts of gender inequality on women’s economic security.

So how can universal old age pensions promote greater gender equality? And what can we learn from the Pacific’s approach to social protection for older people?

The strong development of old age pensions in Pacific Island Countries and Timor-Leste in the last two decades demonstrates important progress towards income protection of women. Whereas the earlier social protection landscape in the region was restricted to contributory schemes for formal sector workers, who are predominantly men, the introduction of non-contributory old age pension schemes has contributed to the creation of more inclusive systems. The universal coverage favoured by most countries means that many women who miss out on employment-related schemes now benefit from some level of income security in old age.

Contrary to the common assumption that the Pacific has little to no formal social protection, P4SP's recent study shows that many countries in the region have significantly expanded their social protection investment over the last two decades, with a focus on increased coverage and inclusion for life cycle vulnerabilities.

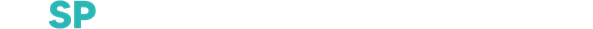

Most countries have rolled out universal government-financed old age pensions, making them the most common form of social protection in the region. Of the 10 countries studied, seven provide old age pensions. Kiribati, Nauru, Samoa, Tuvalu, Tonga, and Timor-Leste provide benefits universally to everyone above the required age, while Fiji provides a near-universal old age pension — only excluding those who are receiving other types of pensions. In all seven countries, old age pensions constitute the highest proportion of government expenditure on social benefits (Figure 1).

Source: Knox-Vydmanov et al 2023.

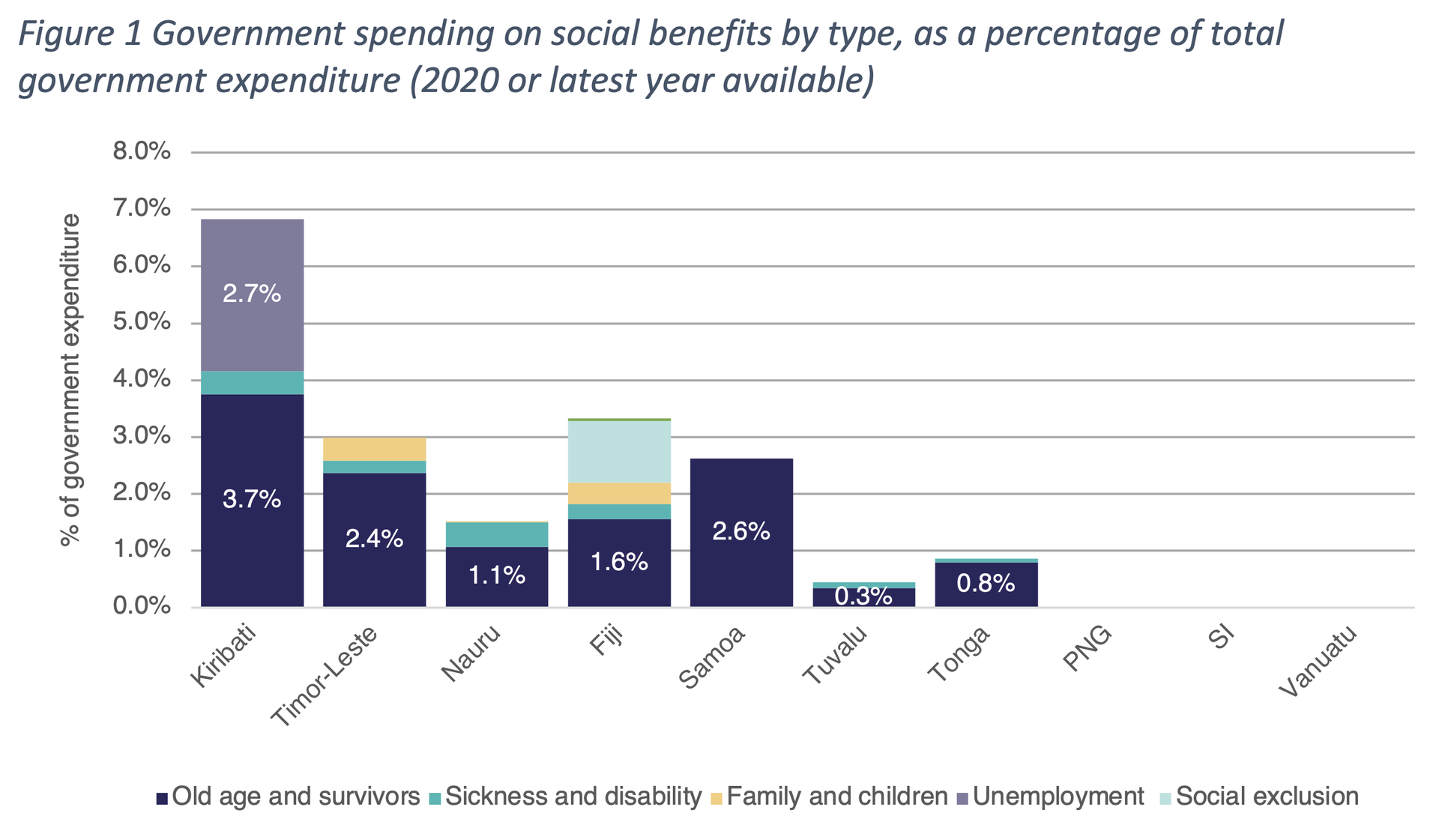

The introduction of government-financed old age benefits, which really took off in the 2000s across the region, represents a significant shift from the earlier focus on contributory provident funds (Figure 2) — investment funds contributed to by formal sector employers and employees (and sometimes governments) to support employees following their retirement.

Source: Knox-Vydmanov et al 2023.

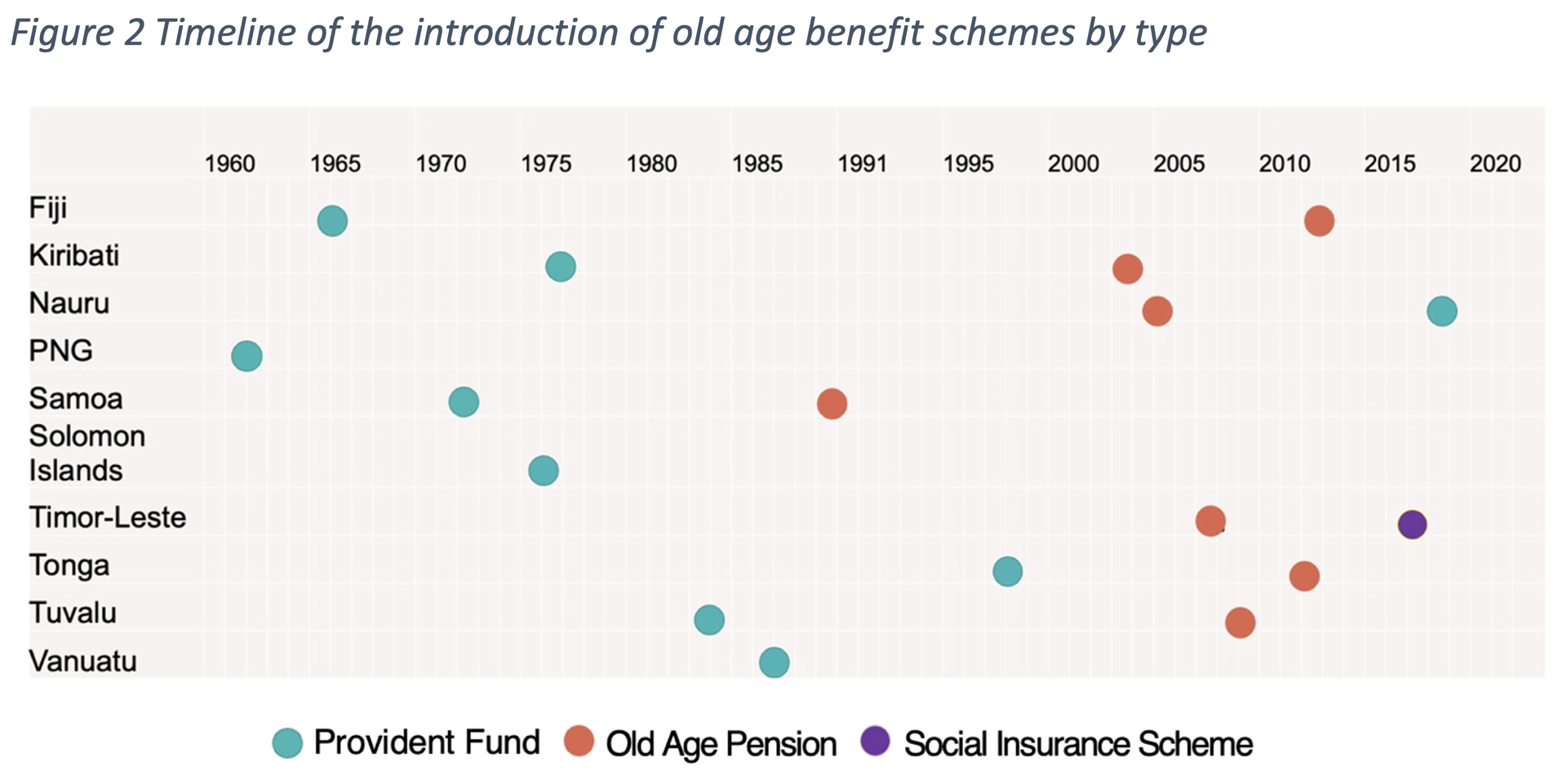

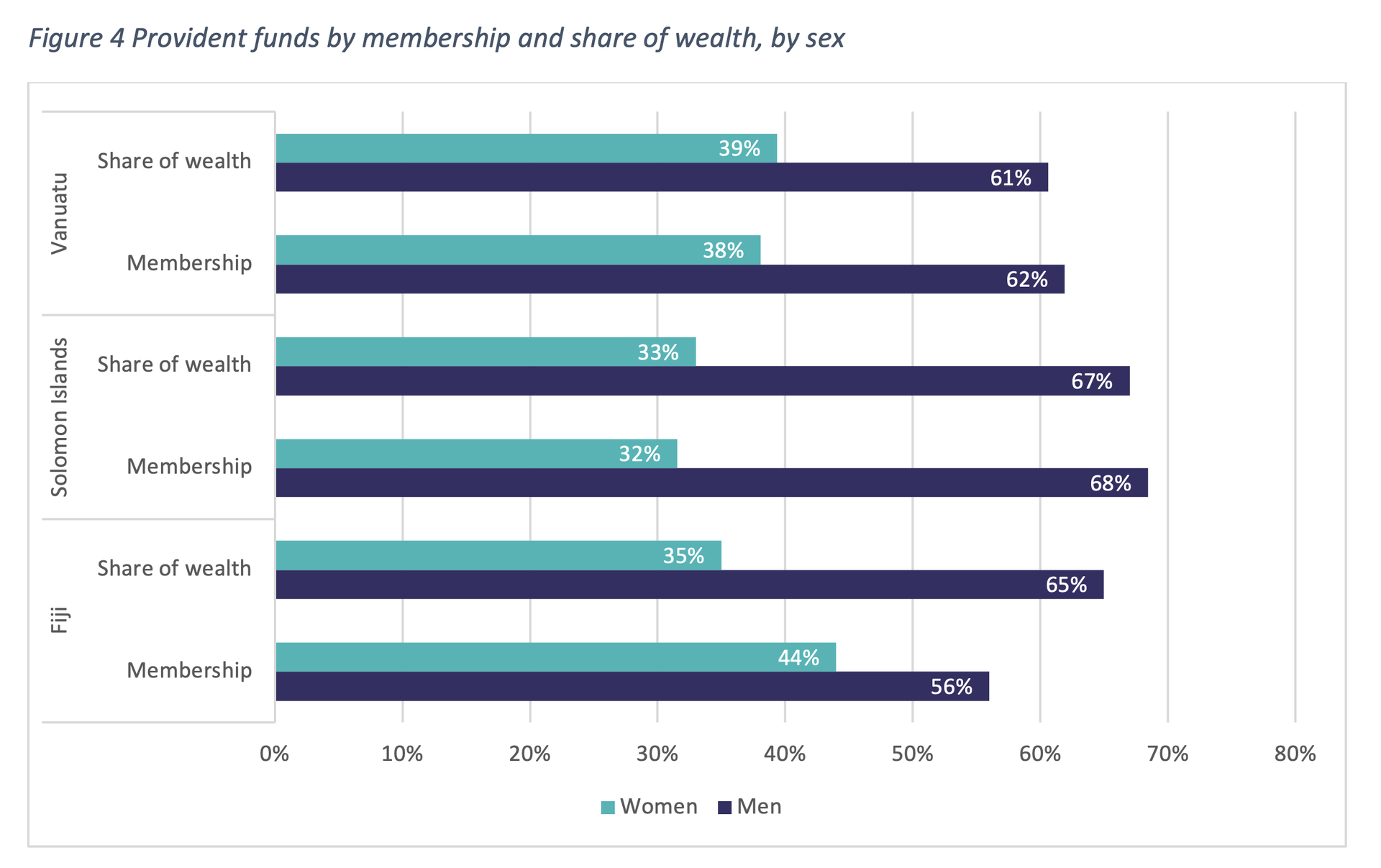

While contributory schemes are important, they tend to disproportionally exclude women. As in the rest of the world, women across the Pacific and Timor-Leste have lower labour force participation compared to men (Figure 3). As such, they are less likely to have provident fund membership (Figure 4). Further, women who are engaged in paid employment are more likely to work in vulnerable employment with low income security and little to no protections (ILO, 2019). This is all compounded by the fact that women who obtain formal employment tend to earn less than men and have more employment breaks due to child rearing responsibilities.

These factors are likely to limit the level of savings accrued by women within provident funds. For example, in Fiji women constitute 44% of provident fund membership, but their share of provident fund wealth is only 35% (Figure 4). Data availability on this issue is limited however, and women’s share of provident fund wealth appears to vary from country to country: in Vanuatu and Solomon Islands it appears to be consistent with the share of membership. More gender-sensitive analysis of how provident funds benefit women compared to men in the Pacific and Timor-Leste is needed.

In contrast to contributory schemes that mimic working-age gender disparities, government-financed old age pensions offer an opportunity to redress some of those disparities. As a non-contributory individual entitlement paid regularly for all people over a certain age, old age pensions provide women with a minimum level of income security that is not contingent on their previous earnings.

Given that universal old age benefits have been a popular social protection investment for Pacific Island governments, it is important to better understand how these schemes operate, and how they benefit older women in practice. Gender-responsive design, implementation and monitoring and evaluation are critical to fully take account of the distinct vulnerabilities women face in old age, including insecure property rights, social restrictions on living arrangements, limited access to services, and longer lifespans, which in turn all increase their need for income support in old age.

For countries yet to invest in government-financed social protection, the popularity of old age benefits across the region offers a potential blueprint for a first investment. With a strong gender lens focusing on the design and implementation of social protection schemes, governments will be able to ensure that old age benefits support women’s economic security in their later years of life, which is better for the community as a whole.

This analysis draws on P4SP’s research paper, From historical trends to investment pathways: Social protection expenditure in Pacific Island Countries and Timor-Leste.

References

Fiji Labour Force Survey, 2015-2016, https://microdata.pacificdata.org/index.php/catalog/277/related-materials

Fiji National Provident Fund annual report, 2021, https://myfnpf.com.fj/wp-content/uploads/2019/09/2021-FNPF-Annual-Report.pdf

International Labour Organization (ILO), 2019, https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/---ilo-suva/documents/publication/wcms_712549.pdf

Samoa Labour Force Survey, 2017, https://www.ilo.org/surveyLib/index.php/catalog/6597/related-materials

Solomon Islands National Provident Fund annual report, 2016, https://www.sinpf.org.sb/index.php/forms-publications/annual-reports/send/2-annual-reports/184-sinpf-annual-report2019.html

Timor-Leste Labour Force Survey, 2021, https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/---ilo-jakarta/documents/publication/wcms_863063.pdf

Tonga Labour Force Survey, 2018, https://www.ilo.org/surveyLib/index.php/catalog/7441/related-materials

Tonga Retirement Fund Board annual report, 2020, http://www.rfb.to/ANR/AnnualReport20192020E.pdf

Vanuatu National Provident Fund annual report, 2019, https://www.vnpf.com.vu/includes/doc/ar/2019.pdf