A CASE FOR INVESTING IN SOCIAL PROTECTION TODAY: COOK ISLANDS

A case for investing in social protection today: The Cook Islands

By Hilary Gorman, Grace Chynoweth, and Juliet Attenborough

Access the easy read version of this blog.

Image: Daniel Fisher/Cook Islands Tourism

Across the Pacific, investment in social protection has been highly variable. But according to earlier analysis undertaken by Partnerships for Social Protection (P4SP), many Pacific Island Countries have made significant progress in developing strong national social protection systems over the past 15 to 20 years. An emerging trend in the region has been observed, whereby national governments prioritise life cycle schemes that address the needs of specific segments of society, such as old age and disability benefits, and then expanding their systems gradually, extending eligibility and increasing benefit levels over time.

Although the Cook Islands was not included in P4SP's paper examining investment trends in social protection in the Pacific region, it does provide an interesting case study of how social protection systems can strengthen, expand and develop over time. The Government of the Cook Islands has invested in social protection for over 50 years and citizens now enjoy a mature system with high coverage levels. Although it must be acknowledged that the Cook Islands is arguably very different from many countries in the Pacific, (characterised by its status as a high-income country - having graduated from the OECD Development Assistance Committee list of Official Development Assistance (ODA) recipients in 2020 and its ‘free association’ with New Zealand, whereby most Cook Islanders hold New Zealand citizenship), as described in this country brief, it does provides a regional example and a potential blueprint of how countries in the Pacific can progressively evolve their systems to and increase social protection coverage.

An analysis was commissioned by P4SP to better understand the Cook Islands' social protection system, how it has evolved, and the ongoing impacts it has had on the wellbeing of Cook Islanders. The analysis comprised a review of existing literature and the collection and analysis of administrative data provided by the Government of the Cook Islands and the dataset of the 2015-2016 Household Income and Expenditure Survey.

With a population of 15,040 spread over 15 islands, the Cook Islands has experienced significant economic growth in the past few decades. Gross domestic product (GDP) per capita increased from NZ$13,300 in 2000 to NZ$28,500 in 2019.

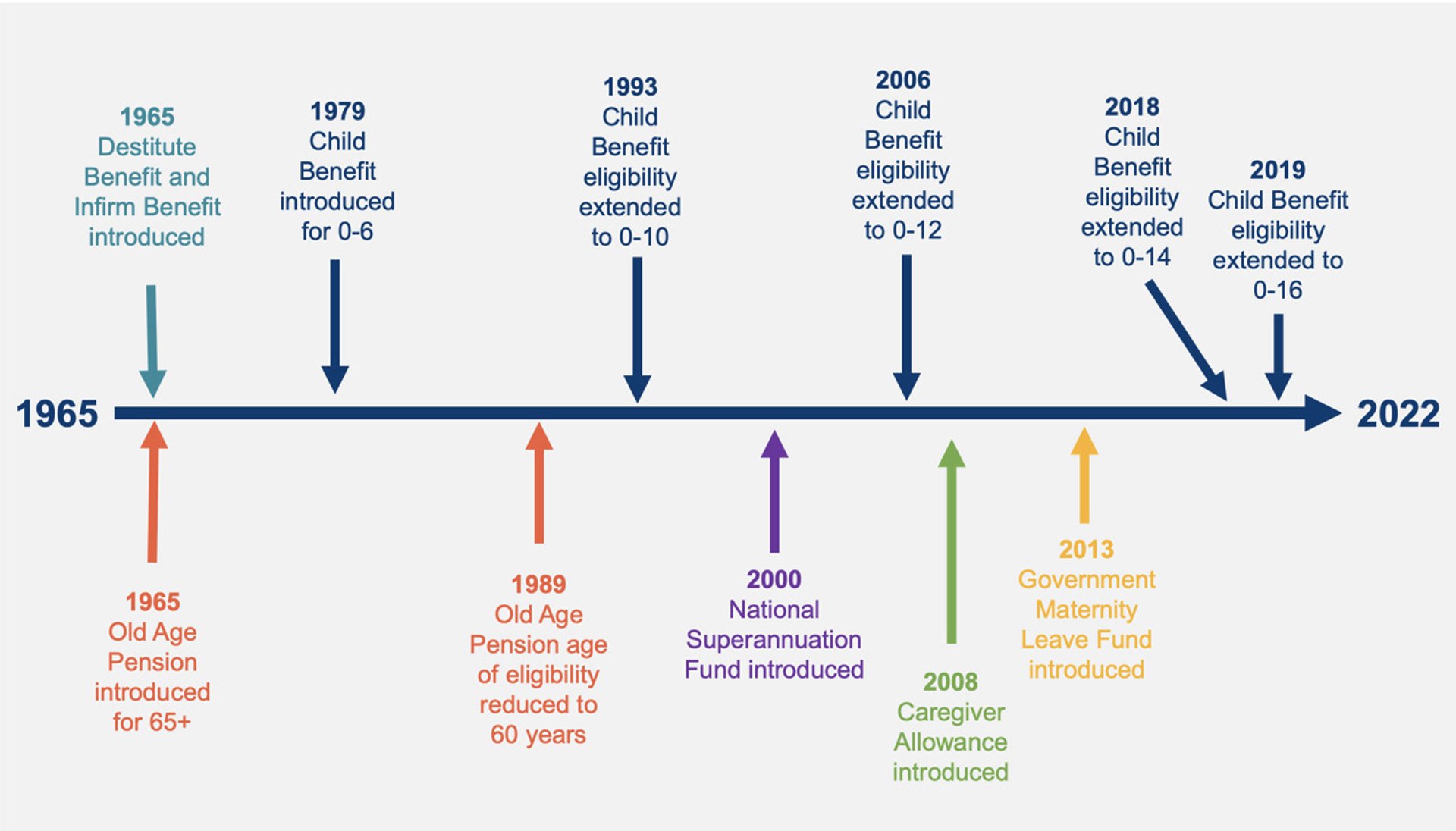

The Cook Island’s extensive and long-standing social protection system is comprised of both tax-financed and contributory schemes. Since its inception in 1965, the system has evolved and expanded, with new schemes incrementally introduced. Large universal schemes that address the needs of the population in traditionally vulnerable life stages, such as the Child Benefit and Old Age Pension, are complemented by additional means-tested support for those facing hardship, such as the Infirm Benefit, Destitute Allowance, and the Power Subsidy— a means-tested top-up for recipients of the Old Age Pension, Infirm Benefit or Destitute Benefit who have no other source of income. Tax-financed schemes now reach an estimated 91% of citizens, either directly or indirectly, at a cost of 4.3% of GDP in 2021.

Figure 1 The evolution of the Cook Islands Social Protection System

Source: Development Pathways

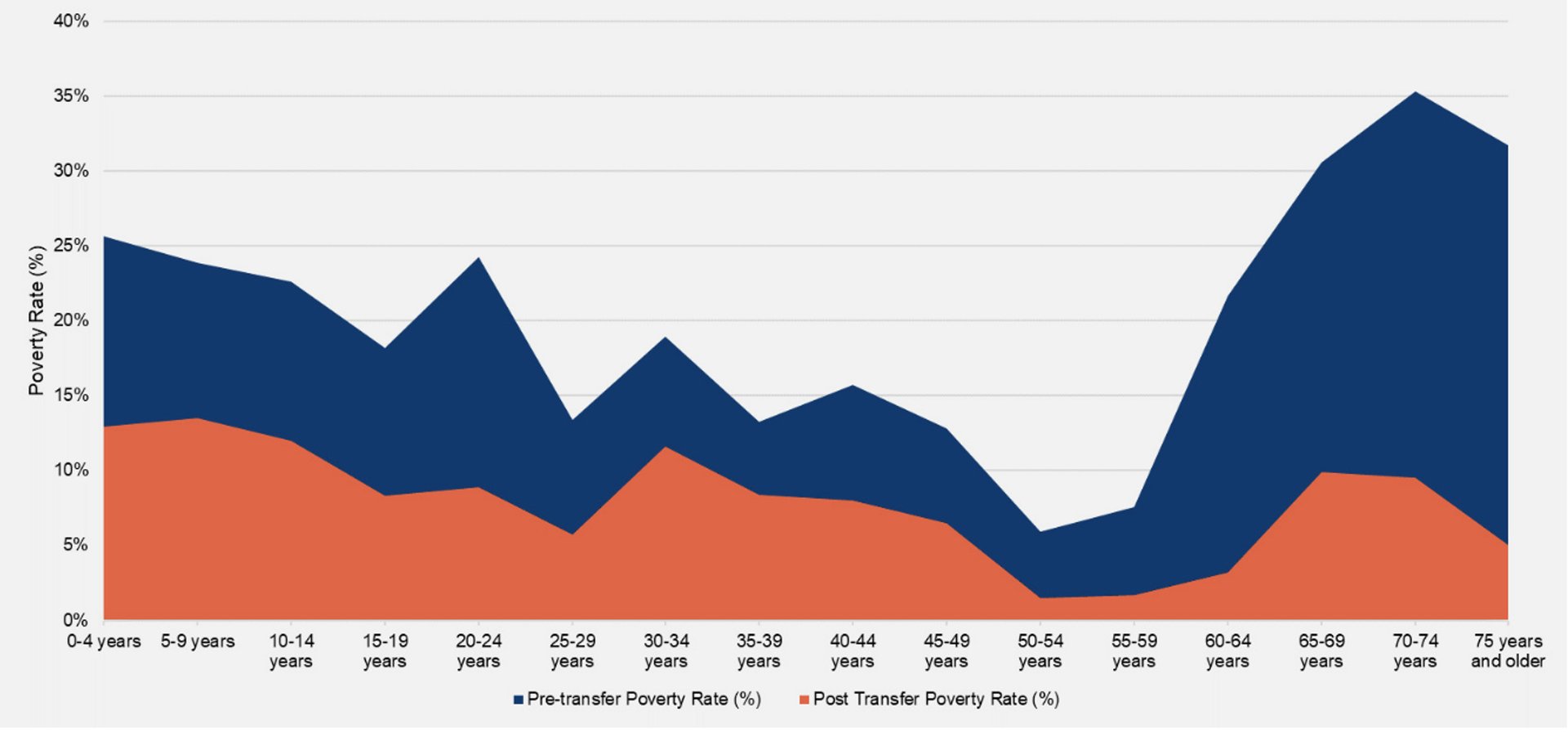

Overall, it’s clear the Cook Islands' social protection system is having a positive impact, decreasing levels of poverty and inequality. The Child Benefit, the Old Age Pension, and the Power Subsidy combined are estimated to have reduced the national poverty rate by 57% in 2016 (the 2016 poverty rate increases from 8.4 per cent to an estimated 19.6 per cent in the absence of the Child Benefit, the Old Age Pension and the Power Subsidy), with the Child Benefit and Old Age Pension having the greatest impact. Unfortunately, the impacts of the other social protection benefits cannot be measured as they are not noted in the 2015/2016 Household Income and Expenditure Survey.The Gini coefficient falls from 0.467 to 0.424. The Gini index is a synthetic indicator that captures the level of wealth inequality for given population group.

Figure 2 shows the impact of the schemes on the poverty rate across all age groups. The three programs together contribute to a 9.2% reduction in inequality. The 2016 poverty rate increases from 8.4 per cent to an estimated 19.6 per cent in the absence of the Child Benefit, the Old Age Pension and the Power Subsidy.

Figure 2 Impact of the Child Benefit, Old Age Pension and Power Subsidy combined on poverty, by age

Source: Simulation using https://microdata.pacificdata.org/index.php/catalog/718

The Government of the Cook Islands’ successful social protection scheme exemplifies to neighbouring countries how investment today can benefit the broader population in years to come. This model demonstrates the cumulative value of the long-term investment in, and the subsequent expansion of, national social protection systems. The government continues to strengthen the system, with a new management information system in design, and a Social Assistance Policy being drafted. This Policy serves as a potential opportunity to reflect on how to ensure equitable access to social assistance for key groups of the Cook Islands’ population, such as people facing hardship and children with disabilities.

Looking forward, the Cook Islands Government plans to increase the duration of paid maternity leave from six to fourteen weeks and increase paid paternity leave from two days to two weeks to support children, women, men, and family wellbeing. Another key priority is to develop a top-up for the Child Benefit to provide additional support to children with disabilities. The Ministry of Internal Affairs is committed to supporting the system to evolve to meet the changing needs of Cook Islanders, especially the most vulnerable.